Confidential Memorandum – Business Plan

A. Managing Health and Medical Care Costs – An Escalating Problem.

Among the most challenging problems in any organization today – whether public or private – is properly managing health and medical care costs. These costs are spiraling uncontrollably, constituting a large and volatile cash outflow. For example, medical costs have increased at an annual rate of 9% over the past two years and comprise about 17% of our country's GDP, equating to the following statistic: roughly one out of every eight total dollars spent in our economy goes toward health care. Another way to describe it: We're spending about $8,656 per person per year according to a 2008 report, on health care.

Unfortunately, the bad news is that such costs are expected to rise even higher. Here are several factors that are driving up health care costs:

- An aging workforce: About 80 million Americans will turn 50 over the next 10 years. The financial impact of this older population will be enormous, since roughly 75% of the dollars that an individual spends on health care in his or her lifetime is spent after the age 50.

- Prescription drug costs: Prescription drug costs are increasing faster than any other health care cost: e.g., 20% to 25% increases are estimated for 2010. Advertising campaigns encourage patients and physicians to request and prescribe expensive, brand name medications. New expensive drugs have entered the market to treat chronic conditions like asthma. Finally, an aging population often needs multiple medications.

- Expensive new technology: Advances in surgery, medical devices, and diagnostic techniques are raising costs for hospitals and health plans.

- Hospital mergers: Hospitals continue to merge, further consolidating the industry and eliminating competition, putting the control of costs into the hands of a few select groups. These hospital groups now have more leverage when negotiating rates with health plans, enabling them to gain significant increases in the costs of their services.

- Liability concerns: Exposure to legal liability and the overall risks for health care providers are greater than ever. Consequently, this risk of litigation is spread to all parties having health care insurance coverage through higher premiums.

Health care costs are inherently unpredictable, whether an organization is (i) fully insured, or (ii) "self-funded," i.e., an employer pays it employees' health care claims out of its general assets (rather than purchasing an insurance policy). Furthermore, given the inherently unpredictable nature of health care costs, much volatility in the organization's earnings and cash flows is caused, which, in turn, has serious financial implications. First, such volatility could cause, at a minimum, a company or government entity to miss its profit and/or budget expectations. In today's environment, where missing profit or budget expectations have significant adverse consequences, properly managing health care costs should be one of the main priorities of an organization. Second, volatility may also create some severe capital budgeting problems. Thus, potential health care liabilities are like a ticking, financial time bomb.

In response, what, if anything, can be done Private companies and governmental entities have tried many solutions: HMOs, cost-shifting to employees, restricting access, self-funding and other strategies have been developed to manage costs downward. Unfortunately, however, the health care management problem persists, and costs continue spiraling upward.

B. Health Care Management Solution: Apex Advanced Funding Model

Rising medical costs are forcing changes in the way health care is paid for, managed and delivered. These changes are not just happening behind the scenes, they require a different approach to the way you get care and more important how it is paid for. Apex Advanced Funding has spent the past 15 years developing a creative and fully integrated model (the "Advanced Funding Model") to handle this problem. As discussed below, the Advanced Funding Model is a risk management program, which includes a funding transaction, the main purposes of which are to: (i) Conclusively quantify an organization's future health care liability and financial risks; and (ii) Prefund such liability, thereby utilizing the available cash flows to convert volatile and unknown variable future costs into a current fixed cost obligation.

The base element of the Advanced Funding Model is a complex mathematical and statistical software program, which has captured detailed, demographic data on more than 22 million lives dating back to the 1950s. It is automatically updated with actuarial and financial market factors each month, including but not limited to, demographic changes, medical CPI changes (including hospital discounting, pharmaceutical trends and technology enhancements), inflationary changes, carrier discounting and physician contracting methodologies. All data is compiled by state, county and region thereby ensuring that the Advanced Funding Pre-funded Model contains an updated and comprehensive compilation of health and medical care cost data. Furthermore, the Advanced Funding Model encompasses much more than the simply the base element: i.e., the Advanced Funding Model doesn't stop at merely statistically and mathematically quantifying the upper limit of health care liability exposure – it also integrates that liability amount into an overall financial risk management tool, discussed below.

1. Basic Steps in Implementing the Advanced Funding Model.

The Advanced Funding Model is a powerful and flexible management tool and may be implemented in the private corporate and government organization sectors, as well as the self-funded and fully-insured environments. The basic steps in implementing the Advance Funding Model are as follows:

(a) Base Element - Quantify Exposure to Health Care Costs: The Advanced Funding Model would quantify an organization's upper limit of exposure to health care costs expected in the upcoming 36-month period. It's important to emphasize that the Advanced Funding Model doesn't change the underlying substantive liability for health care costs; rather, it simply quantifies the upper limit exposure of such liability.

(b) Implementation via Pre-Funding Transaction: A funding transaction would be effected, the specific structure of which would depend upon whether the organization is self-funded or fully insured in handling its health care costs:

- Self-Funded Organizations: If the organization is self-funded, a trust would be formed, which would fund the net present value of the expected health care exposure via either a short-term note offering or loan transaction. The trust would be the primary obligor of this debt, and the Parent Organization's employees would be the beneficiaries of the trust.

- Fully Insured Organizations: If the organization is fully insured, the funding transaction would be used to advance fund the insurance premiums for the next three years, which would be based on the liability exposure as quantified by the Advanced Funding Model. Apex Management Group would negotiate with the insurance carrier to discount the premiums, consistent with the Advanced Funding Model. For more information, please refer to the attached Appendix A, which describes actual case studies of fully-insured government organizations that have implemented the Advanced Funding Model, detailing how the quantified liability exposure is relied upon to renegotiate the insurance premium, resulting in a significant cash flow savings.

(c) Process for Ultimately Paying Health Care Claims: The Advanced Funding Model would not change the specific process of how the organization ultimately pays its health care costs. It should be emphasized that the Advanced Funding Model is a risk management tool, requiring neither any changes to the organization's substantive administration of health care, nor to the employee workforce.

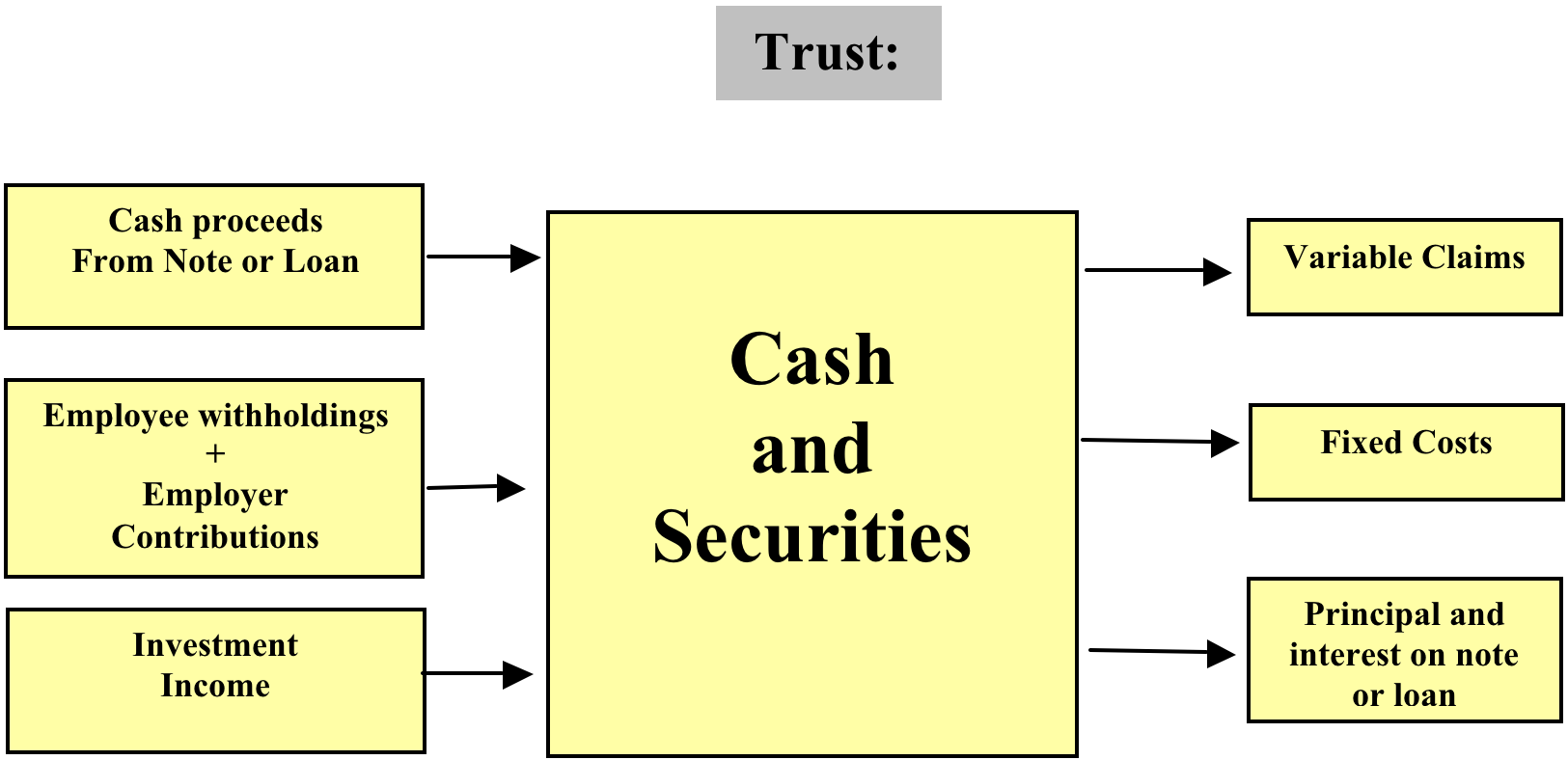

- Self-Funded Organizations: If the organization is self-funded, the Trust would pay the total health care costs and would service the principal and interest on the note or loan. In particular, the cash from the funding transaction, plus the employee/employer contributions and investment income would be held by the trust to pay future health care costs and service principal and interest on the note or loan. This cash would also be reinvested in a conservative fixed income portfolio.

- Fully Insured Organizations: If the organization is fully insured, the funding transaction would raise money to advance fund the insurance premiums for the next three years. Consequently, the health care claims would simply be processed through the insurance carrier in the same manner as before implementing the Advanced Funding Model.

2. General Legal Structure of Implementing Advanced Funding Model.

While the Advanced Funding Model may be implemented using various legal structures, here is a chart depicting the general legal method:

As shown, the cash proceeds from note or loan, plus the employee withholding and the employer contributions and investment income keeps the trust in a fully cash collateralized position. The trust property then would pay both variable and fixed costs and service the principal and interest on the note or loan.

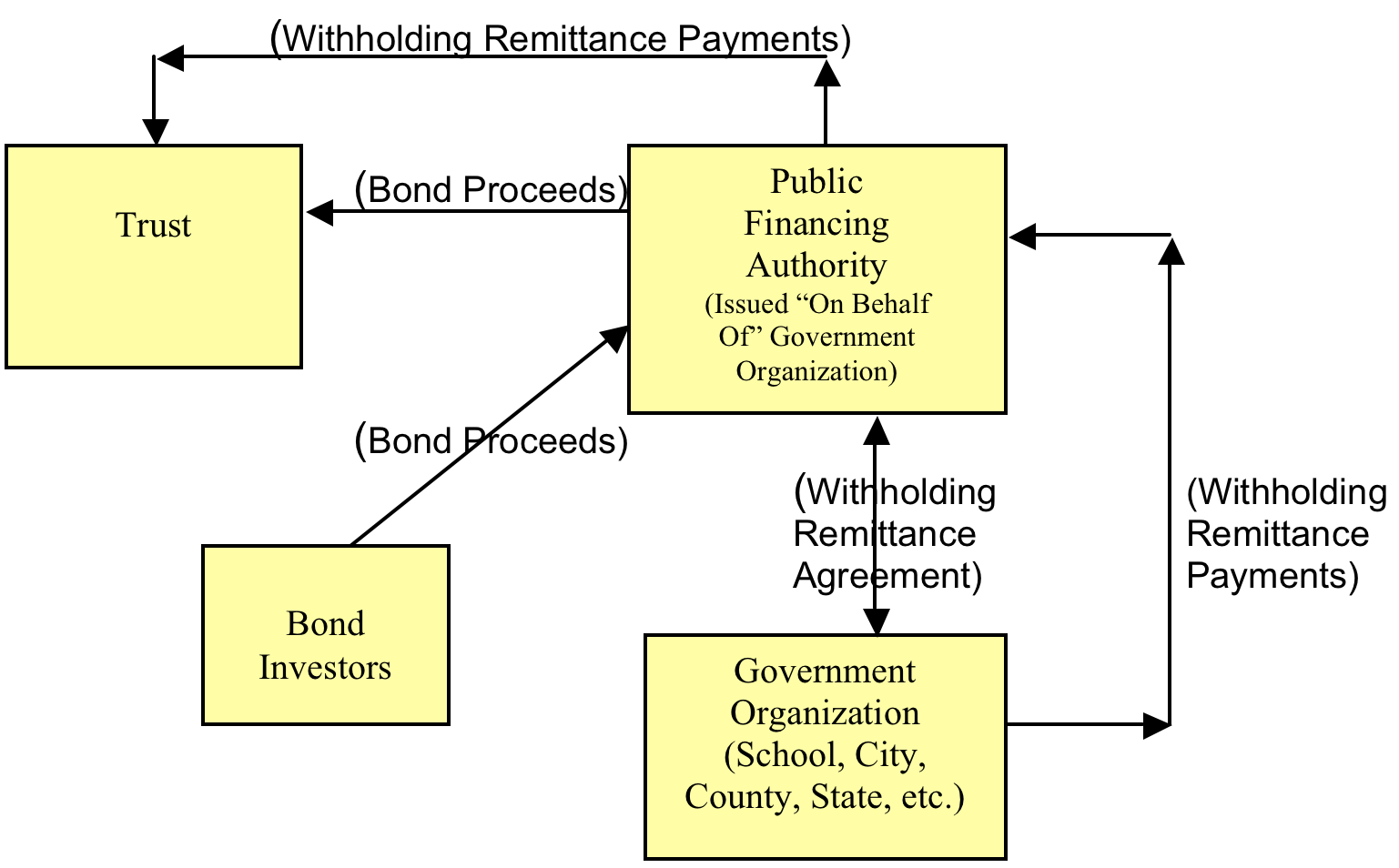

3. Modified Legal Structure - Implementation of Advanced Funding Model by Government Organizations

Government organizations may face additional complexities and sensitivities relating to financings and liabilities, which could be resolved by slightly modifying the structure of the Advanced Funding Model, as follows. First, a Public Financing Authority (PFA) could be selected to actually issue short-term notes to fund the trust. These notes would be issued "on behalf of" the relevant governmental organization. This funded amount would be used to pay health care claims. Second, the governmental organization's obligation would consist of merely forwarding payments as required under a Withholding Remittance Agreement. Third, the relevant payments under the Withholding Remittance Agreement signed as part of the Advanced Funding Model could be further structured as being subject to an "annual appropriation", thereby preventing a liability from arising for accounting purposes. Given no more than an annual appropriation, no liability should be recorded, since the issuance would be literally subject to annual renewal by the governmental organization. Finally, another important factor is that the annual appropriation structure should not affect the government organization's debt ratios and/or debt ratings. Restated, the Advanced Funding Model would change nothing of financial substance; therefore, the debt ratios should remain unaffected. No new liabilities would be created by the Advanced Funding Model. These strong conclusions are supported by the fact that, in a recent $78 Million deal involving implementation of the Advanced Funding Model by Jefferson County, Alabama, Moody's Investors Service in New York assigned the transaction its "Aaa" rating (Moody's highest rating). Moody's assigned its rating only after conducting an exhaustively detailed review of the Advanced Funding Model. (For your information, a copy of this Rating Opinion is available upon request.)

Here is a simple chart and cash flow illustration depicting the Advanced Funding Model, implemented in the government context:

Variables Contracts 3688 Average Monthly Ins. Cost 1813825 Current Growth Rate 4.00% Financing Rate-Loan 1.00% # of Months 36 Corridor Level Funding 25.00% T.V.M. Discount Rate 4.00% TPA Interest Rate Assumption 0.65%

Results Total Note $81,084,714 Clients Remmitance $1,973,712 Monthly Payment $2,287,246 Excess Reserves $3,484,873 Excess Percentage 4.30%

YEAR 1 Month Client's Declining Balance Witholding Remittance Interest Income Monthly Reserve Coverage Ratio (A) (B) (C) (D) (E) 1 $81,084,714 $1,973,712 - $1,973,712 102.43% 2 $83,058,425 $1,973,712 $43,921 $2,162,785 102.74% 3 $81,027,824 $1,973,712 $42,827 $2,349,561 103.07% 4 $78,993,075 $1,973,712 $41,729 $2,531,238 103.40% 5 $76,951,376 $1,973,712 $40,628 $2,707,794 103.75% 6 $74,902,704 $1,973,712 $39,523 $2,879,209 104.12% 7 $72,847,035 $1,973,712 $38,414 $3,045,459 104.50% 8 $70,784,345 $1,973,712 $37,301 $3,206,523 104.89% 9 $68,714,613 $1,973,712 $36,184 $3,362,379 105.31% 10 $66,637,813 $1,973,712 $35,064 $3,513,004 105.76% 11 $64,553,923 $1,973,712 $33,940 $3,658,377 106.22% 12 $62,462,917 $1,973,712 $32,812 $3,798,476 106.72% YEAR 3 Month Client's Declining Balance Witholding Remittance Interest Income Monthly Reserve Coverage Ratio (A) (B) (C) (D) (E) 25 $34,603,323 $1,973,712 $17,780 $5,109,634 118.72% 26 $32,408,487 $1,973,712 $16,595 $5,170,121 120.65% 27 $30,204,478 $1,973,712 $15,406 $5,224,978 122.95% 28 $27,992,951 $1,973,712 $14,213 $5,274,179 125.73% 29 $25,773,880 $1,973,712 $13,015 $5,317,702 129.17% 30 $23,547,240 $1,973,712 $11,814 $5,355,522 133.56% 31 $21,313,006 $1,973,712 $10,608 $5,387,617 139.37% 32 $19,071,153 $1,973,712 $9,398 $5,413,961 147.46% 33 $16,821,654 $1,973,712 $8,184 $5,434,530 159.52% 34 $14,564,484 $1,973,712 $6,966 $5,449,302 179.55% 35 $12,299,619 $1,973,712 $5,744 $5,458,251 219.47% 36 $10,027,031 $1,973,712 $4,517 $5,461,353 338.97% 37 $7,746,694 - $3,287 $3,484,873 - Ending Balance 36 Month Totals - $71,053,615 $864,146 $3,484,873 -

4. Advantages of Advanced Funding Model

In summary, quickly review the bottom-line advantages of implementing the Advanced Funding Model:

(a) The Advanced Funding Model would convert a previously unknown volatile amount into a known and manageable fixed cost, thereby reducing the "surprise" potential (which is punished by Wall Street). In turn, this would reduce the volatility in earnings and cash flows;

(b) The Advanced Funding Model would establish an identified budgetable flat line health care cost for the next 36 months. Currently it is difficult for management to budget long term for such costs, leaving a large hole in the organization's strategic plan.

(c) There should material bottom-line cash flow savings, whether the Parent Organization has a self-funded system or is fully insured. In a self-funded environment, the savings relate to the time value of money held by the Trust: The liability amount is pre-funded on a net present value (NPV) basis, while the payments out of the Trust are subject to significant "lag" delays of filing, processing and verifying proper employee claim payments. This lag between receiving cash and paying claims will irrefutably create positive cash flows for the Trust. In contrast, if the Parent Organization is fully insured, the insurance premium could be renegotiated and discounted, based on the quantified health care liability amount.

(d) There would be no material out-of-pocket costs to implement the Advanced Funding Model. The combined employee paycheck withholdings plus parent organizations contributions would flow directly into the trust and remain fixed for the next 36 months. Furthermore, the trust's cash would pay all future health care costs. Thus, the great uncertainty of dealing with health care costs would be eliminated.

(e) Creates long term cost control and provides the opportunity to negotiate long term discounts with fixed cost providers (TPA's, Re-insurance, etc.) by advance funding.

(f) Shifts focus from a reactive to a proactive financial management strategy.

(g) The Advanced Funding Model would add much "transparency" to the Parent Organization's financial statements. In a post-Enron business world, the market demands complete transparency in financial reporting. The Advanced Funding Model helps meet this requirement, since no material health care financial items should be left unknown; and

(h) By virtue of having received an "Aaa" rating from Moody's, the Advanced Funding Model is a tried and proven risk management tool, offering organizations the ability to achieve favorable funding levels.

C. Legal, Tax and Accounting Analyses

1. Question: Does Quantification of Health Care Claims Give Rise to an Accounting Liability?

After the health care claims exposure amount is quantified by the Advanced Funding Model, but before it's actually funded, certain accounting issues arise. First, such claims exposure amount should not rise to the level of an actual "liability" for financial reporting purposes. For a liability to be recognized, it has to meet the following three conditions:

- The obligation involves a probable future sacrifice of resources – a future transfer of cash, goods, or services or the forgoing of a future cash receipt – at a specified or determinable date.

- The firm has little or no discretion to avoid the transfer; and

- The occurrence or event giving rise to the obligation has already occurred.

In the case of the health care claims amount quantified by the Advanced Funding Model, the third condition is not met; therefore, the amount should NOT constitute a liability for accounting purposes. In particular, the amount would not meet the liability recognition criteria since the underlying event, i.e., the employee's future sickness episode, would not have occurred and thus no liability should exist for accounting purposes. Such future events cannot be a liability for accounting purposes, since a distinction is made between past and future events: while a past event can be a liability, a future event cannot. A supporting analogy would be future wages of employees, which are neither capitalized nor recorded as a liability. Future wages and future health care claims should be consistently treated for accounting purposes. Furthermore, remember that the Advanced Funding Model doesn't change the underlying substance of the health care costs, i.e., it doesn't create or change the underlying amount. Therefore, since the Parent Organization doesn't currently record a liability, the Advanced Funding Model should not alter this treatment.

Second, for purposes of bank and financial analyst ratio review purposes, no liability should exist from the Advanced Funding Model's quantification of the health care claims exposure amount. No accounting liability exists and the Advanced Funding Model would not substantively change or create any debt amount; rather, it merely quantifies the upper limit of health care costs. In fact, the Advanced Funding Model vastly improves a company's "transparency" factor in financial reporting, which should be well-received by banks, as well as by the Wall Street analyst community.

2. Question: What are the Post-Quantification Implications?

After the health care claims exposure amount is funded via the trust, more legal, tax and accounting issues arise. While the quantified amount of expected health care claims would not be a liability for accounting purposes, the net present value amount borrowed would be a liability. The treatment of this latter liability amount is discussed below.

(a) Financial Reporting Treatment of Bond or Note: The amount borrowed by the Trust would be a liability recorded by the Trust. However, the Parent Organization should not be required, for GAAP purposes, to consolidate the trust's operations (i.e., the trust's cash and related bond or note payable) in the Parent Organization's financial statements. The reason is that the Parent Organization would not control a majority voting interest in such trust operations. In fact, it would not hold any beneficial ownership interest whatsoever in the trust's property. Thus, the cash proceeds and related note or loan payable (which should approximately equal each other, netting to a zero balance) should be isolated within the trust; therefore, such amounts should not be required to be reported on the Parent Organization's balance sheet.

(b) Income Tax Treatment:

The trust implementing the Advanced Funding Model should be further structured to allow it to gain exempt status from federal income taxes, qualifying as a so-called VEBA trust (Voluntary Employees Beneficiary Association). The main requirement would be that no part of the trust's net earnings could inure to the benefit of any person (other than the payment of health care claims of employees or their dependents). The trust formed as part of the Advanced Funding Model should qualify as a VEBA trust, (a VEBA trust is not necessary; and in most cases, unless a VEBA is already in place; a VEBA trust is rarely used) thereby being exempt from federal income taxes.(c) Bankruptcy Treatment of Parent Organization and Trust:

If the Parent Company were to go bankrupt, its creditors should not be able to reach the trust's property. The reason is that, while the Parent Organization would be the technical creator of the trust, it would not own any beneficial interest in the trust's property. Rather, the employees would own the entire beneficial interest in such property. Therefore, the trust should not be subject to the claims of creditors of the Parent Organization.

How to implement the Advanced Funding Model: What Next?

Phase I: Situation Assessment Report* - Timeline 10 - 15 days

- Analysis of Financial Data

- Review of current benefit costs

- Review of utilization history (3 years)

- Underwriting

- Interview designated senior executives to gain perspective of the goals and objectives of the current health care benefit program

- Itemization of projected costs and savings

- Review of funding alternatives

- Summary "Situation Assessment" to be presented to Executive Group

- Recommendations for Phase II

*Note: Standard Proposal and Retainer Agreement, Retainer Fee and Mutual Confidentiality Agreement required prior to commencement of Phase I activities.

Phase II: Negotiations and Implementation - Timeline 30 - 60 days

- Develop and review implementation plans

- Negotiations

- Carriers

- TPAs

- Reinsures - Securing of finances

- Develop and draft contracts/documents

- Implementation

Success Fee for Implementation (Retainer Fee credited)

Phase III: Financial Management

Semi-annual financial review and analysis

APPENDIX A

(Actual Case Studies of Fully-Insured Clients)

Background – In 1995, a new financial program was built to approach the market with a non-traditional approach to stabilizing and potentially limiting the cost of health care benefits for employees. The pre-funded or advance funded program uses the leverage of health care premium dollars as the backbone to negotiating on behalf of an employer a three-to-five-year cash flow and savings opportunity when purchasing in a fully insured environment. Moreover, the pre-funded program has proven to create total budgeted health care expense while initiating long term cost control strategies, illustrated by the following actual case studies.

San Bernardino County - In 1996, the first fully funded transaction took place in San Bernardino County. At the time San Bernardino initiated the pre-funded program, their trend increase has been in excess of 17%. By initiating a pre-funded approach over a thirty-six-month period with their carrier, San Bernardino County was able to save in excess of $5,000,000. San Bernardino negotiated a pre-funded transaction that paid Aetna the equivalent of $44,100,000 through a revenue bond issue provided through Miller Schroeder & Smith Barney. This up-front payment mitigated a project expense in excess of $52,200,000. After debt service and commissions were satisfied, San Bernardino saved approximately $5,000,000 (excluding $1,500,000 in deficit carryover waiver provisions negotiated) in over all projected premium exposure.

Tulare County - In 1997, Tulare County produced the same results by initiating the same strategy producing a present-day value savings of approximately $3,400,000.

Berks County – Capital Blue Cross has provided Berks County with a quote based on the benefit plan design contained in Berks County current health care benefit contract and benefit booklets. The contract period for the pre-funded transaction is between the dates of April 2002 to March 2004. The cost history for Berks County has identified a steady 15% - 18% increase over the past three-year period. The expense assumption for Berks County under the fully funded program for Primary Group Numbers: 22368, 22369, 22370, 22371, and 5333 were based on actual trend and experience, for the next three years were: $47,409,504 representing a 16% annual average trend factor. Due to underwriting consideration of a change in benefit design and an increased focus on cost containment by Berks County the actuarial assumption was identified at: $42,448,832 representing a 10% annual average trend factor. By instituting the pre-funded methodology, Berks County was able to negotiate a gross savings over a three-year period of $2,432,737 and a present value savings of $3,027,576.12. By virtue of the pre-funded offer, Berks County proposed to Capital Blue Cross a pre-funded amount of approximately $36,724,477. Capital Blue Cross accepted based on the advanced funding of the three-year premium thus giving them guaranteed finances for County premium, retention, savings related to re-marketing costs and internal rate return capital on the funds advanced. Additionally, by advancing the premium, Capital Blue Cross agreed to waive an additional $594,000 in "deficit carry-forward" amounts owed to Capital Blue Cross because of adverse utilization and lack of cost control over the annual term period past 2001. The anticipated rate of future costs as it relates to the above benefit design is identified between 13.5% - 16%. The cost increase and cumulative trend will stay consistent with the results found in the several actuarial studies done on the current Berks County demographics/case mix, enrollment, plan design, while also integrating trending credit for benefit design changes made prior to the transaction resulting in increased cost control over an extended period of time. The changes made to offset exposure from a design perspective will not show its complete value until at least 24 months from date set herein.

Benefits – The benefits are clear. For the employer the benefits include: total predictability, establishes an identified long-term budget, generates cash flow opportunity, creates long-term cost control, institutes partnerships between carrier/cost manager, incorporates a guaranteed services contract and shifts focus from reactive strategy to a proactive management strategy. For the employee the program offers a level premium opportunity, strong customer service guarantees, and focused attention to care management and stabilization for health care provider over an extended period. For the carrier the program offers client retention, savings related to re-marketing costs and a potential "upside" related to their internal rate of return on the advanced premium accrual.