Creative Thinking In Managing Health Care Costs

Employer organizations are looking for new solutions to remain competitive

Key Questions

- Would your organization like to level out costs for the next 36 months?

- Does a 3 year fixed monthly health care cost make sense for your organization?

- Would your C-suite executives prefer to work on growth & profitability instead of shock claims issues due to health care volatility?

The Problem

- Managing health care costs

- Costs increasing annually at double digit rates on a national basis

- Cost pressures continue to grow for all employers

- Plan Sponsors are forced to absorb the growing financial impact

Managing Health Care Costs: A Breakthrough Solution

Apex Advanced Funding has developed a proprietary model that quantifies healthcare costs incurred by employers. Future health care costs are converted into a more manageable “budgetable” item that may yield significant savings. The actuarial software module of the Apex Advanced Funding Model, brings to market a non-traditional method of stabilizing the volatile cost by bringing together all of the disciplines necessary to implement the Model. The Apex Advanced Funding Model, which is financially rated by Moody’s, is a turnkey solution joining actuarial sciences, health care benefits specialization, corporate, legal, accounting and asset management.

The Solution: The Apex Advanced Funding Model

The Apex Advanced Funding Model uses its proprietary software to design and help eliminate uncertainty by projecting and implementing a fixed health care cost for a Plan Sponsor for the next three years, while alleviating under-funded liabilities and compliance issues

In either a self-funded or fully insured environment, the volatility of health care costs is eliminated, since the money used to pay either claims or premiums for the next three years becomes available at funding. Formerly unknown and unpredictable costs are converted into a current fixed-cost obligation, with future health care costs becoming a defined “budgetable” line item for the next 36 months

- More than 20 years of development

- Complex and proprietary mathematical, statistical & actuarial software model program

- Populated with database of 22 million lives dating back to the 1950’s

- Updated monthly (various demographics)

- Compiled by state, county & region

- Legal & business structure of financing transaction integrated into the Apex Advanced Funding Model

Structure Elements and Providers

The Trust

- Organized under IRC§501 (c) (9)

- Trustee – Wilmington Trust - Wilmington, Delaware

- Asset Manager – Principal Financial Group, Des Moines, IA

Private Placement Agents

- The Frazer Lanier Company - Montgomery, AL

- Loop Capital - Chicago, IL

Structuring Team

- Structure Developer and Implementation – Apex Advanced Funding, Oak Brook, IL

- Legal Counsel – Schulte, Roth & Zabel, New York, NY

Implementing the Apex Advanced Funding Model

Phase I: Advance Funding Stress Assessment to Quantify Exposure

Initially, Apex Advanced Funding completes a comprehensive stress assessment to quantify your organization’s upper limit of exposure of health care costs over the next 36-month period. It is important to note that the Apex Advanced Funding Model does not change the underlying liability for health care costs; rather, it simply quantifies the upper exposure of such liability.

Phase II: Advance Funding Implementation

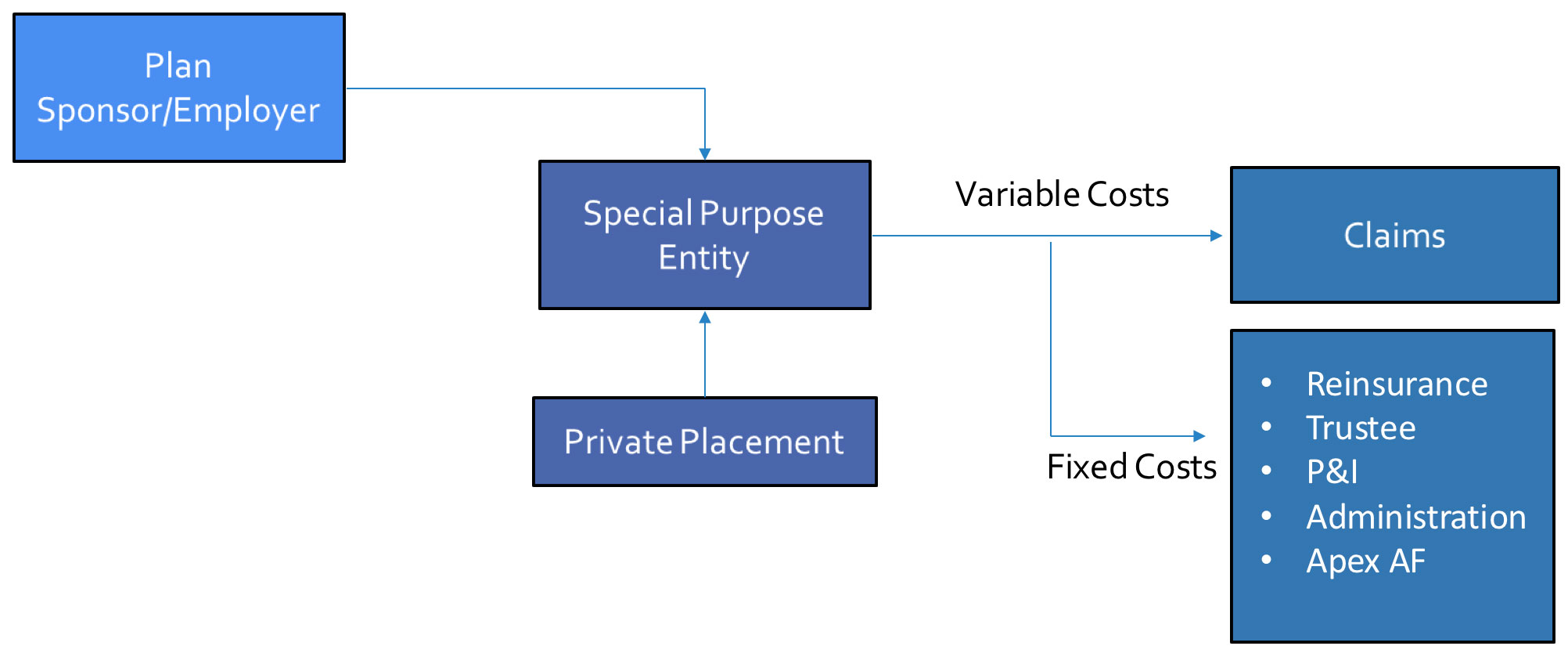

Based on the quantified liability, a financing transaction is completed. For self-funded pools, a Special Purpose Entity (SPE) is formed to fund the net present value of the liability. The SPE is the obligor of this debt (not your organization) and the organization’s employees are the beneficiaries of the trust. If the organization is fully insured, the financing transaction is used to raise the money to advance fund the insurance premiums that are discounted, consistent with the liability exposure as quantified by the stress assessment.

For self-funded organizations, the SPE will pay the total health care costs for the next three years and service the principal and interest on the note or loan. It is important to emphasize that Apex Advanced Funding Model does not change the process of how the Plan Sponsor pays its health care claims. If your organization is fully insured, the total premium for the three-year term is paid in advance and the health care claims are processed through the insurance carrier in the same manner as before.

Benefits of the Apex Advanced Funding Model

The Bottom-line advantages of implementing the Apex Advanced Funding Model are numerous:

- Converts previously unknown and volatile amounts into a known and manageable fixed cost, and consequently reduces budget surprises

- Establishes an identified “budgetable” flat-line health care cost for the next 36 months filling a large gap in the organization’s strategic planning

- Creates material bottom-line cash flow savings, whether the Plan Sponsor is self-funded or fully insured

- No material out-of-pocket costs to implement the Apex Advanced Funding Model

Employer Benefits

- Total predictability

- Establishes an identified long-term budget

- Generates cash flow opportunity

- Creates long-term cost control

- Shifts focus from reactive strategy to a proactive management strategy

Employee Benefits

- Offers a level premium opportunity

- Strong customer service guarantees

- Focused attention to management and stabilization for health care providers over an extended period

Carrier Benefits

- Offers client retention

- Savings related to re-marketing costs

- Potential "upside" related to their internal rate of return on the advanced premium accrual

Process Timeline

Day 1

- Client signs NDA (Non-Disclosure Agreement)

- Client Supplies all relevant data, i.e. census, claims, Rx data, etc. For the past three years

Day 7

- Apex commences analytics and refines three-year exposure

Day 14

- Apex opens discussion with client’s consultant to agree on assessment of risk

Day 21

- Alta Trust Company opens trust account and sets up payment timing with all related parties

Day 31

- Apex secures funding for Principal Financial Group

Day 45

- Advanced Funding closing date. All monies transferred to trust. Client makes first level remittance

Monthly

- Client makes level remittance for 35 additional months. All fixed and variable costs are paid monthly out of Alta Trust Company

Monthly

- Apex reviews all relevant data submitted by Trustee and Client to assess all identified exposure targets

Quarterly

- Apex prepares actuarial report, valuation analysis and reserve study for meeting with client and consultant

Contact Information

Contact the Apex Advanced Funding principals for a consultation:

Jeffrey Bemoras

Email: jlbemoras@apexmanagementgroup.com

Chris Stepuszek

Email: cstepuszek@apexmanagementgroup.com

Reach us at our office: (800) 359-0329