Creative Thinking In Workers' Compensation Costs

Employer organizations are looking for new solutions to remain competitive

Key Questions:

- Would your organization like to level or custom design your Workers Compensation payments for the next 60 months?

- Would your organization like to be rid of the required LOCs?

- Would your organization like to take this liability off your balance sheet?

Our Solution Set: The Apex Model

- We have built a suite of tools that will address many of the issues workers’ compensation plans face today

- A Workers’ Compensation financing structure that quantifies workers’ compensation and other related costs

- Using a sophisticated actuarial model to clearly define and manage cash outflow given a chosen confidence level

Our Two-Tiered Solution:

- Analyzes the existing arrangement employers have with their providers

- Develops a financial remedy to contain, budget, and fund costs without modifying existing conditions

The Value Proposition

The Apex Model brings the following value to any plan by:

- Establishing an identified and budgeted flat line workers’ compensation cost over 60 months

- Mitigating the need to post LOCs based on the overall collateral established by the fund to cover future exposures over 60 months

- Creating a medium term horizon which allows flexibility to adjust and revise trend data in future funding cycles

- Shifting from a reactive to proactive financial risk management strategy which insulates an organization’s general fund

- Containing volatility to facilitate a cost effective long-term funding and budgeting platform

The Apex Advanced Funding Structure

Apex Advanced Funding

Our Advanced Funding solution has been used effectively for over a decade and can provide Plan Sponsors with:

Five Year Rate Guarantee

- Certainty for Worker' Compensation managers and their employees in an uncertain world

Consistent Monthly Payments

- Predictable and consistent cash flow budget for the Plan Sponsor well beyond the current year

Creates no Obligation on Company's Balance Sheet

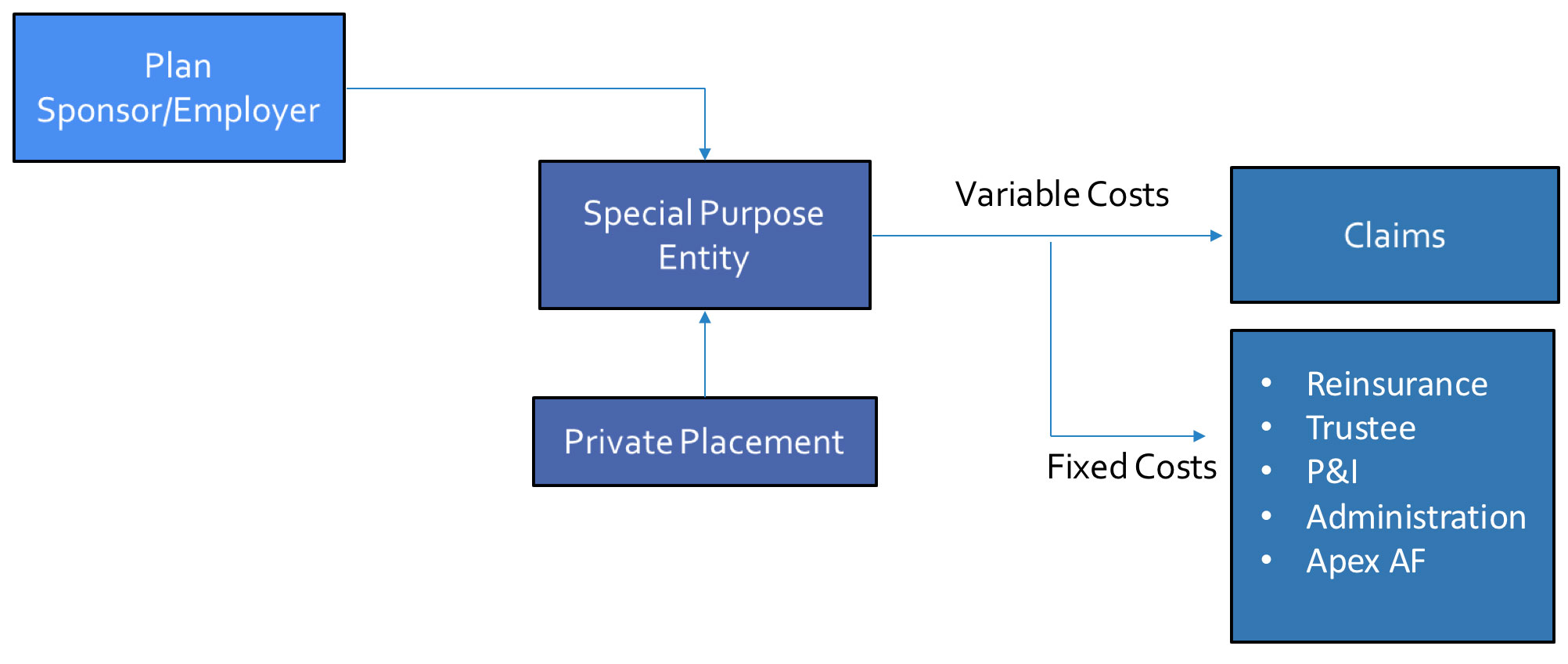

- An independent Special Purpose Entity (SPE) utilizing debt, so that the obligation is held by the SPE - NOT the Plan Sponsor

Working With You and Your Consultant

We securitize your workers’ compensation liability over five (5) years by:

- Utilizing a SPE that is separate from the business and for the benefit of plan participants

- Accelerating the tax benefit locked in your reserves

- Establishing a level 5-year or custom designed cash flow expense

- Creating a structure that makes earnings more predictable – remittance to the SPE is your expense

Information Needed for a Phase 1 Assessment

- An actuarial report that identifies your “paid” and “reported losses” and allocated loss adjustment expense development by fiscal year for the last 3 years

Structure Elements and Providers

The Trust

- Organized under IRC§501 (c) (9)

- Trustee – Wilmington Trust - Wilmington, Delaware

- Asset Manager – Principal Financial Group, Des Moines, IA

Private Placement Agents

- The Frazer Lanier Company - Montgomery, AL

- Loop Capital - Chicago, IL

Structuring Team

- Structure Developer and Implementation – Apex Advanced Funding, Oak Brook, IL

- Legal Counsel – Schulte, Roth & Zabel, New York, NY

Contact Information

Contact the Apex Advanced Funding principals for a consultation:

Jeffrey Bemoras

Email: jlbemoras@apexmanagementgroup.com

Chris Stepuszek

Email: cstepuszek@apexmanagementgroup.com

Reach us at our office: (800) 359-0329